Where are the $100m+ African exits? part 1

Would prefer to see a listing

It’s been a constant, scary nagging quest for me for the last year. What appears like a simple question, actually isn’t. As I have asked questions from the community, I have found it increasingly difficult to get a solid and acceptable answer. The most common response I get is, I believe it will happen. I usually tilt my head and ask ‘Why?’, ‘Why do you believe it will happen if it hasn’t happened already?’. I know Nigerians have the unique ability to suspend reality and believe, it literally explains the state of Nigeria, rather than focus on fundamental fixes for the problems of today (let’s not get started for tomorrow’s). We just wait for God to take control because Nigeria has wealth (it doesn’t) and we are God's chosen people (evidence points to the opposite. We are truly forsaken). I thought the tech community was different. I thought it was more introspective, more scientific, more honest. 10 years ago, if you had asked me whether I thought things were going to be this hard, in one simple word; Ineverexperredit*

Even though I don’t want to admit it, I guess I would be considered an old head when it comes to VC-backed startups in Nigeria. I feel that if we Hunkus and Hantys are not evaluating how far we have come, what that means for the youts by not sharing our stories, then we are part of the problem that makes Nigeria seem like a secret society. So in that vein. Ladies and gentlemen. We have a liquidity problem.

As I read listicles screaming ‘Africa’s hottest startups who have raised at least $5m in 2018' or ‘Momentum for Angel investors’ and feel a new flush of enthusiasm, I remind myself that similar articles were everywhere when my class [2009–2013] of entrepreneurs was starting out.

The year 2018 has been on a high note for the African startup ecosystem with the increase in the number of VC’s, angels, corporates, accelerators, funds, and incubators interested in the African startup space.

27 startups have raised more than US$5 million in venture funding totalling US$572.2 million. In addition, funding activities in the continent are still concentrated majorly across Kenya, Nigeria, and South Africa with Egypt startup scene also rising up. read the full article

AND

Although there are no African companies in the Fortune 500, there are currently over 400 African companies with annual revenues exceeding $1B. African companies grow faster and with more profits than their global peers and 2018 saw the 30th African startup venture join the $5M Investment Club of ventures on the continent that have raised over $5 million in funding. Read the full article

Jumia, isn’t it?

This started as a tweet storm, but for lifetime value, I thought it better as an actual blog post. It’s something I have struggled with over the last few years as I mature as a husband and father of three, with wave after wave of school fees facing me for the next 20 years — I always talk about schools fees as when you get to a certain salary bracket —I would say USD six figures — pretty much everyone around you is quietly concerned with ever escalating school fees. The current ending school year for my x3 1-5 year olds for their combined fees were ~$34.1k. This is Montessori nursery, o. Not like it’s boarding or anything. As O + K are going into bigger school in September, it’s looking like $50–60k/year for the next few years. I have a mentor who throws a party every time one of his kids leaves public boarding school in the UK. For his current two secondary school age kids, he is paying $110k/year. AFTER TAX! It’s a 5% problem I know, but it’s a problem nonetheless. Folks think the Njokus are rich. I can go on record to assure you. We are not. But, I digress. Swiftly moving on.

As IROKOtv is currently 7.5years old, the next 2.5 are super critical for me and the team. What kind of company are we to become? I feel a VC-backed startup after 10 years should have a very clear view of what investor liquidity looks like. A very clear path needs to be sought. Otherwise my sense is we are spinning wheels.

Walk with me down memory lane

2011–2016, within the first 5 years of IROKOtv’s existence, we raced up to $50m in valuation. It sounds glib and a little strange when I tell people that this is a relatively simple endeavour. If you raise $15–20m in Venture Capital, those who believed enough and who gave you that money will see fit to value the future prospects aggressively, so attaining a valuation of $50m+ or that range shouldn’t be considered a big deal once you start the VC path. In Africa, it’s what happens next which is the big issue. Very few, if any, normal African Venture-backed or even organically grown technology companies have crossed that chasm from $50m+ into $100m+. What happens? Konga blew past that very early on, carrying the hopes and dreams of the community on her shoulders. But ultimately couldn’t sustain the white hot growth needed to propel it to an exit (even with ~$150m in VC raised). And when I mean couldn’t sustain it, the VCs simply stopped believing and the funding stopped shortly after. The last year or so of Konga’s existence was meeting budget and funding at 3-month cycles. If it appears the mass layoffs etc. were jerky and abrupt? That’s the reason. Then one day, it was decided. Sell or shut down. Konga 2.0 is meh, I would have preferred it put to sleep. There are so many others who attempted to ride the e-commerce wave. Tapped into the early investors’ ambition and tried to build something of significance and couldn’t. So they stopped investing. The most prominent funds of that era - Tiger Global, Kinnevik, Intel Capital, Adlevo, Naspers etc. have all but stopped investing in Africa — note, they are still investing limited amounts in SA.

2016-today IROKOtv (including our incubated business like ROK) reached to ~$70m valuation, and we have basically been defending that ever since. It could be that the space we are in cooled (it has), it could be it was perceived we didn’t hit product market fit (element of truth, people are not using paid products fast enough), it could be that 100% of our competition collapsed as the brutal market for paid TV became obvious (there again, the field has cleared), it could be a number of reasons. It could be my leadership? Damn. It truly could be just me.

Whatever the reason. As Fintech, Mobility, Y Combinator alumni startups burst out and capture the imagination of a new class of capital, the most evident difference is that the traditional VC which built the first class of internet companies in Nigeria and across Africa are no longer there. In recent deals, you have noticed they are now replaced by much more corporate Venture Capital and Private Equity. Canal+ (the first kind of VC investment they did was in IROKO), TPG / Rise Fund, Orange Digital Ventures, Visa, Goldman Sachs, Helios, Carlyle Group, Endeavor Catalyst, IFC, CDC, Visa, Vostok New Ventures and Mastercard.

So after 10 years of internet startups in Nigeria and Africa, how many companies have reached exit in the $50–150m range? I am defining exit as a material liquidity event for founders and /or early investors.

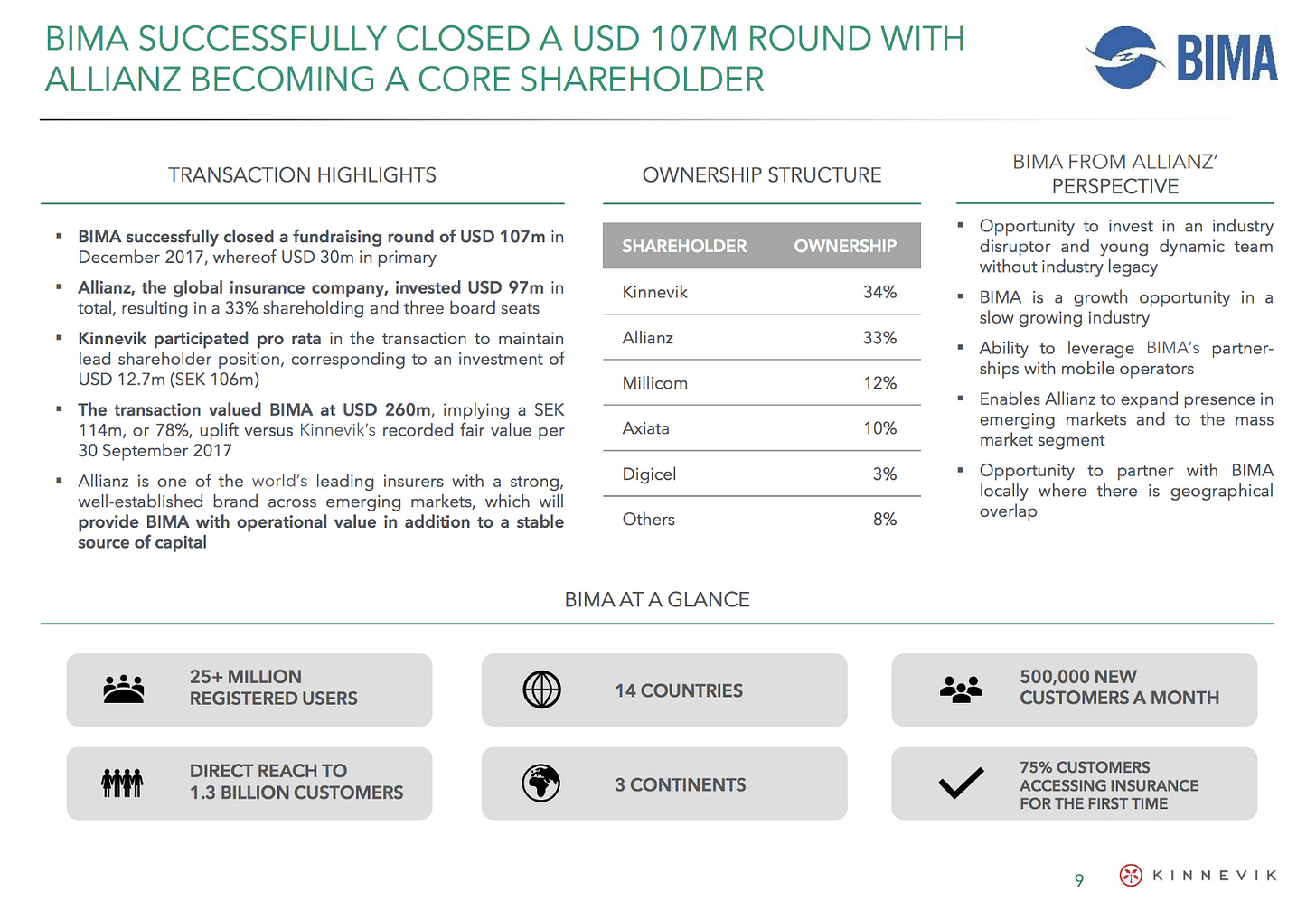

BIMA — major VC exit, Leapfrog sold its entire equity in a $107m transaction ($67m secondary $40m primary) to Allianz X

The funding — $40 million of which is in equity, and the remainder as secondary transaction to buy out shares primarily from LeapFrog, another investor — was made at a pre-money valuation of around $260 million and gives Bima a post-money valuation of around $300 million, deputy CEO Mathilda Strom said, in an interview. Bima, which has headquarters in London and Stockholm, has raised over $150 million in funding to date. BIMA is split between Africa and other markets. This one is a little different as it was ‘founded’ by Gustaf Agartson, yet from its origins it was always a corporate Venture Capital project. It didn’t really have ‘founders’ and as you can see, above management are marginal owners at best. I am attributing 40% of the value of the transaction to Africa, thus it counts as an exit to me.

Time to exit: 8 years

FAWRY — Helios led consortium acquired 85% for $100m

Founded by Ashraf Sabry in 2008, Fawry is Egypt’s first and largest electronic payment network. Fawry earned $26.8 million (210 million Egyptian pounds) in 2014 after serving more than 15 million Egyptian customers. Today, more than 1.3 million payment transactions are performed daily on Fawry with 50,000 distributors, over more than 300 cities and districts all over Egypt.

Time to exit: 7 years — they are planning an IPO in 2020 on EGX

FUNDAMO — Visa acquires for $110m

Privately-held, Cape Town, South Africa-based Fundamo boasted more than 50 active mobile financial services deployments across more than 40 countries, including 27 countries in Africa, Asia and the Middle East.

Fundamo’s deployments currently have a base of more than five million registered subscribers and the potential to reach more than 180 million consumers with mobile financial services.

Fundamo CEO Hannes van Rensburg and the executive team will continue to manage current and future Fundamo implementations as members of Visa’s mobile product organization

Time to Exit — 12 years

WEBUYCARS — Naspers acquires 60% controlling stake for $99m

According to the company itself, Webuycars was founded in 2001 by Faan and Dirk van der Walt and grew into a business that sells close to 3,000 motor vehicles each month. Although it is being held up by the Competition Commission in SA, it deserves a mention.

Time to Exit — 18years

Sam Paddock. Pic by Jon Pienaar

GETSMARTER- Acquired by 2U for $103m

South African startup that delivers short-term online certification courses to distance-learning students in partnership with many of the world’s top-tier universities. The price tag for the deal is $103 million in cash plus an earn-out provision of as much as $20 million in cash.

GetSmarter was founded in 2008 by two brothers, Sam and Rob Paddock, and was previously self-funded until last year, when it raised $5 million from Digital Growth Africa Middle East (DiGAME), a subsidiary of Zouk Capital. GetSmarter claims to have served more than 50,000 students globally with a course completion rate averaging near 90%. Headquartered in Cape Town, the company says it saw approximately $17 million in revenue in 2016 and has some 400 employees, including performance coaches, technologists and video producers, as well as academic tutors that operate remotely around the world

Time to Exit — 9 years

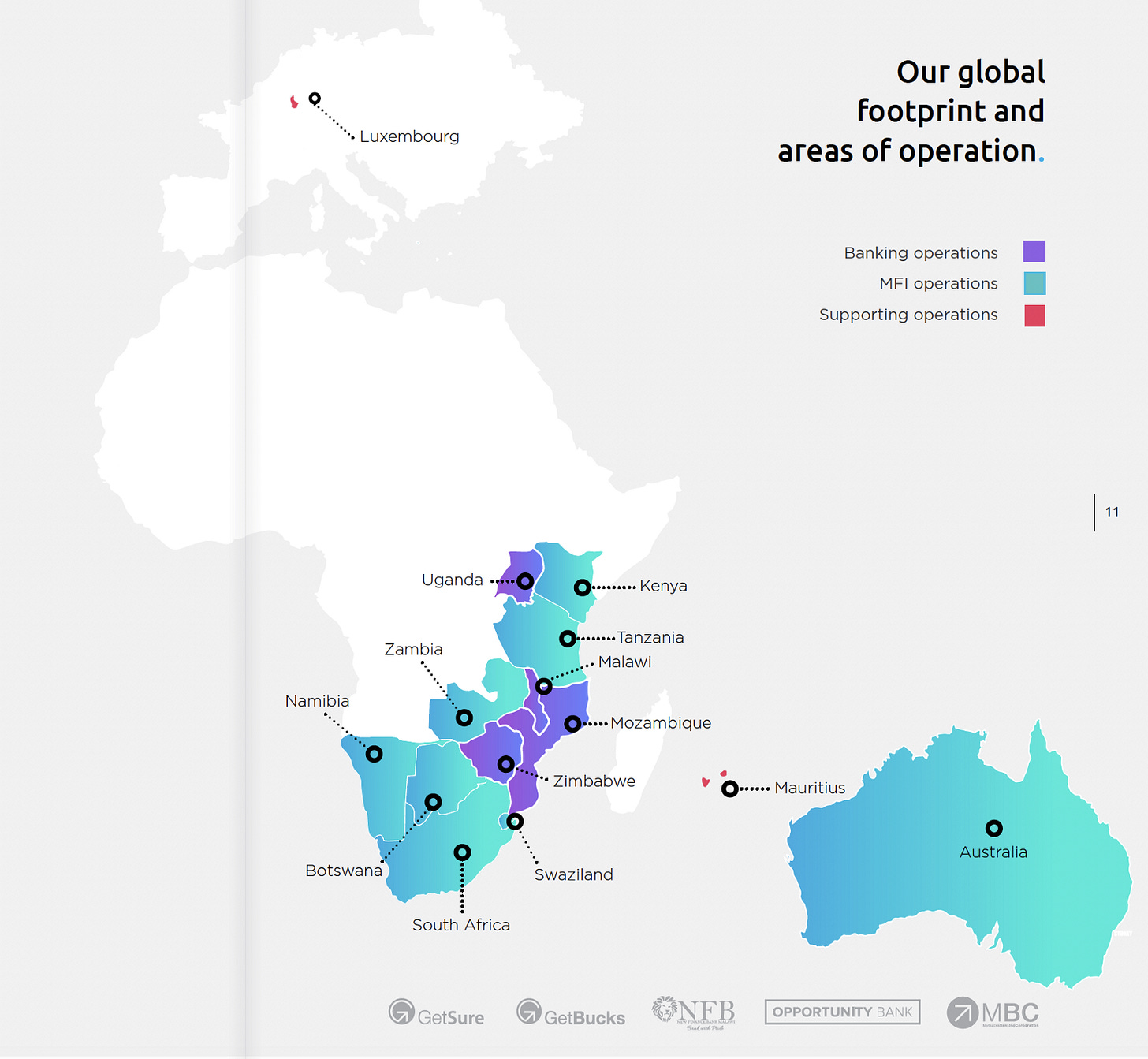

mybucks global footprint

In 2016 MyBucks became the first Fintech company listed via an IPO in Frankfurt. At the time they raised €15.5m, had more than 300 employees and 400 sales agents and operations in 11 countries, the MyBucks Group has already disbursed over €140 million in consumer loans, resulting in top-line revenue of over €30 million in business year 2014/15 (July 2014 through June 2015). The IPO was at $150m market cap, but by the looks of things they haven’t performed well at all. By the looks of things they are sitting at $10.6m. Ouch.

Time to Exit — 5 years

Missing but acknowledged. I understand Vanso at $50m (N15B) would be an example of an exit, but was unable to verify the information independently so I simply left it out. Folks in my network point to Interswitch, but that is the very definition of a corporate venture project. The $96m majority investment from Helios Partners made shareholders of the bank rich. TA Associates also invested last year and cash out shareholders, but again I couldn’t ferret out more independent information.

The Africa summit at the LSE. Good photo op. I prefer an actual media or tech listing. But that’s just me.

In summary. We have a Macro problem.

Middle East & North Africa (MENA)— The region closest to us in Africa — have been seeing pretty massive exits over the same period. Yahoo acquired Maktoob for $164m (2009), Cobone acquired by Tiger Global for $40m (2013), Amazon acquired Souq for $580m in cash (2017), Uber acquires Careem for $3.1B (2019) et al.

I thought it good to share a few Nigeria centric inputs from my network, which provide another perspective on the macro picture.

VC model simply does not work in Africa unless investors are ready to fund to scale (in layman's terms, to fund the company's losses). Which they are not. So VC model simply does not work.

The Macro issue will always always be there. Between 2011 and 2019 the Cedi and the Naira devalued by over 150%, something that was heading for 10x would have become 3x. So that devaluation line is very difficult to cross over, unless you are a pure dollar company. And there were very few of those.

The rule of Law. The the cost of capital, returns you need to make, are so high in Nigeria today that it scares most investors to a standstill. Which explains the turnover.

Part 2 is coming soon

To the tweet-storm that inspired Part 1 of this article.

In 2015, 40% of @PropertyProNG (a Spark portfolio co) was acquired by emerging market classified group Frontier Digital Ventures. Their plan was simple. Roll up classified assets — > list on the ASX. Bastian & I thought this impossible. VCs told us you need at least rev $100m/year

Fast forward four years, FDV listed two years ago, has a AU$166m ($115m) market cap. To us it was improbable a young company could even think about listing. Made no sense. But we were short-sighted. We were operating in Africa. Our mates are operating in liquid markets.

In FY18, FDV generated $12.8m in revenues and $10.3m in losses. Africa hasn’t seen many liquidity events $20m+ let alone $100m+. FDV did this all in <5yrs. This is actually super normal for ASX. E.g. In FY17 ReadCloud in a “heavily oversubscribed” IPO raised AU$6m at AU$16m market cap with revenues of AU$608,000 & net profit of AU$147,000. Today it’s AU$28.4m ($19.5m). I like this company. A lot. But an IPO candidate? In Africa.

But that is real value. Real monies to pay school fees. Currently in Africa we have an emerging ecosystem driven by hype and hope. Eventually we need exits. There needs to be liquidity. The Lyft, Uber, Slack-esque angel exits are not going to happen here. Abeg people, stop me. I know quite a few media & tech companies in Nigeria who could demonstrate ReadCloud kind of growth. But would they be funded? Dunno. Would they IPO after a few years. People will laugh you out of the room. Whatever the liquidity model we need to find and own our own.

Mrs Njoku thinks it’s mid life crisis ‘tings. Just don’t want to celebrate 10 years of @irokotv (2021) and be wondering what’s next. Am I wasting my time?

*Divine Oduduru is a national treasure. He is breaking records in the USA. Divine shows what happens when talent is taken out of Nigeria and nurtured.

**Please don’t draw me into the Jumia unicorn debate. But let me go on record. They are the very definition of a corporate soulless venture project. Regardless of the success. Their IPO means nothing. To my mind it has had zero impact on the funding environment for Nigeria (or perhaps African) based startups and does little to offer any insight into the liquidity issues we currently face. Again from my limited knowledge very few if any ex-early employees or angel investors or VC funds made bank on this one. If I’m wrong, do let me know. If it's for ecosystem PR value. Good luck with that. What we need is meat. Not myths. As my big chief Asemota would say. HOPE IS NOT A STRATEGY