A $120–150m IPO for IROKO in 2021

Speaking about Monetisation at the Bloomberg Africa Business Media Innovators 2019 in Dakar, Senegal

If you didn’t know. IROKOtv has definitely made her dent in the universe. We are seen amongst the biggest boys and gals in media.

In simple terms, I have dedicated my life to solving problems and building value on my own terms. Always on my own terms. It doesn’t make people fall in love with me, and in fact most people recoil at my blunt force (I would say merely direct) approach to everything. I try to bring extreme energy and honesty to everything I do. I’m not here for the love. I am here to win and make sure I can pay school fees. On 30th August 2011, the day the first $3m landed in our IROKO account from Tiger Global, I signed myself up for something else. As a newly minted venture backed business, I now had to create shareholder value. That ‘win’ needed an IRR attached to it. I had a number to hit. Anyone who follows me on Twitter (Ironman 70.3 training) knows what I do with numbers. I obsess and try to crush them. That IRR number responsibility I take very very seriously. Even when shareholders discourage me, I still push forward to do what is their best interest. At least when I believe it is the case. Example. ROK.

Most of my board at the time were against building out ROK. The conflicts of interest were clear (my wife was the CEO & founder) and I was the commercial guy - 90% of the ROK deals I did personally myself. From personal relationships. I took significant amounts of my time away from IROKOtv to build out that business, to the angst and anger of Bastian, management team and the other board members at the time. There was a ton of resistance, ‘this wasn’t the business they had invested in’. That was until I dropped a $1m per year 3-year deal on the table for ‘approval’. With a subtle, ‘oh I had a pipe line of 3–4 more deals just like this’. We exited ROK after 5.5 years (IROKO invested just $1.4m in equity). A business my management team and cofounder never actually wanted me to build. But it's alright. It's all about winning, right? Last week, IROKO approved a special $5m dividend for shareholders. I used 60% of my personal dividend to re-up my shareholdings in IROKOtv. The rest, to make Mrs Njoku happy, part-bought our first family house. I can now focus. She and the kids are happy(ish). I am super super long IROKO. I believe more now than I have ever believed before. With the ROK sale, as long as we are conservative with cash and hit our numbers (still doing budgets) we should have enough capital for the next 2 years+ in losses or to reach cash flow positive. The sooner the better. But more importantly to end the first 10 years of IROKOtv, I believe it's best to take the company public. This runs completely counter to the current narrative of billion dollar exits in Nigeria’s tech scene.

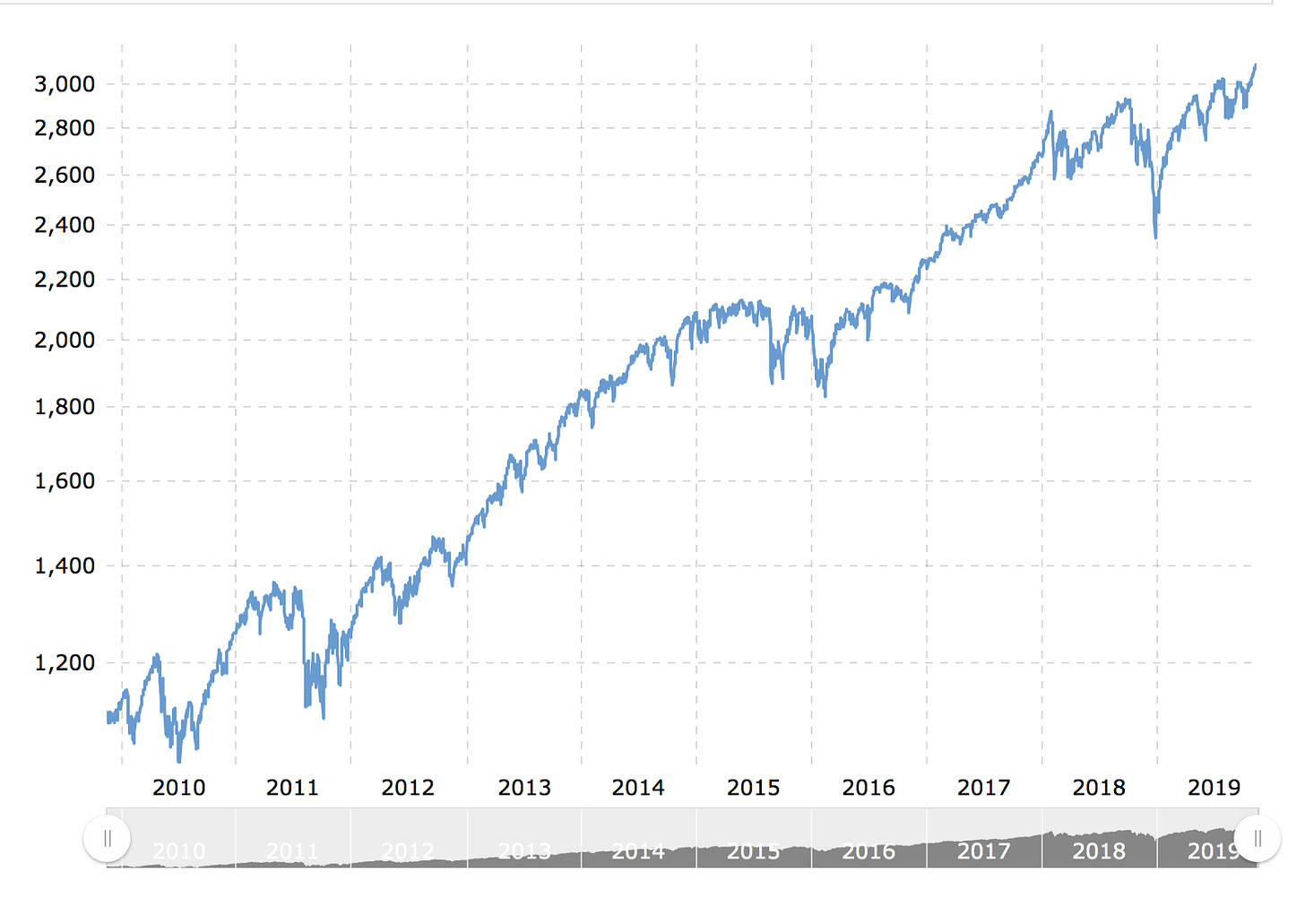

It's interesting that I have been discussing this ad nauseum with the tech community in Africa since I wrote [Where are all the $100m Exits] and its largely been seen as the most stupid thing to do at this point. It’s like they believe I lack ambition or maybe I am just too old, so I'm missing the point. Companies go public at $1B+ baby. Deals are being done every week for $30–40m-50m, fuck it $200m deals. Fuck it x2. $700m valuations baby. It's the peak time to be raising and going for it! That’s fantastic. For me. Maybe I have seen it all before. I like to think about what the next decade (2021–2031) at IROKO looks like, what kind of capital structure would benefit customers, employees and existing shareholders. I think an actual liquidity event is more logical at this stage. For Tiger Global, our first investor and largest shareholder (33.36%), I think an IPO in 2021 would be a good step forward for them to close out a decade of ownership and see a return on their original investment from 8 years ago. Ideally we would be able to solidly beat the 10-year S&P 500 index return over their investment period. Cherry meet cake.

I thought there would be some encouragement from folks. Not really. It is left to me to be out there on the edge. Super experimental. When I wrote about the 3,000% exit of IROKOtv angel investors via a secondary shares sale, that was news to most people, they didn't really know it was a thing. But it was welcomed news. Now it's pretty common practice in these parts. Whereas I don’t take any credit, I would like to think my contribution made that conversation easier at board and shareholder levels

S&P 500 Index Return.

For us to be successful as a collective, we need to return capital to shareholders. IT'S THAT SIMPLE. We are not an NGO so that IRR needs to being significantly higher than the ~10 %S&P 500 Index(for US investors) at the minimum. Otherwise investors will simply stop investing. Risk adjusted, it doesn’t make any sense for them to. My wish for the Nigerian tech scene is if we get to the stage where we have 2–5 of these annually. For me, winning is when we can hit $100m+ liquidity events in <10 years with founders (individuals or teams) owning 20–30%. (At IROKO today it’s Bastian Gotter at 9.74% and I at 16.85% — not including options and it’s all common stock. No preferences, no funny business). If those companies can go on to grow into $250–300m companies on public markets. Better. Tiger Global own 33.36% of IROKO. If we list at $100m+ (excluding the special dividend from last week) that would give them ~100% return on their money. At $100m that would be a 7.5–8% IRR over 10 years. A bit of a waste of time.

I think if we can grow IROKOtv to $300m in valuation within the 12–18mth post IPO lock up period (normal for LSE AIM companies), then their $16m (their last actual investment was in March 2015) would be worth $100.8m then it would 630% (x6.3) return. The IRR would be 18.22% (over 11 years). Not spectacular. But also not a complete and utter waste of time. I would think most investors would be pretty happy with that outcome. Phase 1 of Shareholder value mission complete. Onto the next 10.

Based on our direct conversations with stockbrokers, NOMADs, auditors and lawyers, an LSE AIM listed company valued at $100m would need to have (ultra conservatively) $8–10m in revenue and $0–1m in EBITDA. They are willing to fund losses for high growth, but that always changes. I would prefer to be conservative. For that same company to be at $250m-300m valuation, it would be required to generate $25-$30m in revenue, $2–5m EBITDA and have a clear multi year annual growth outlook of 15–20% (BOKU, SUMO and DOTD are examples of this — although their losses and profits swing outside of this conservative range). IROKO is not there today. But we expect 2020 to be our foundation year which will give us the clear path to run at an IPO in H1 2021.

I’m tired now and actually need to go back to work. I will write about the mechanics and technical details around a listing with my actual experiences of meeting with the good folks at LSE and the advisory . Going public isn’t the end of the journey. But it can be seen as the end of the beginning. IROKO is a multi decade company and ending the first 10 years with a liquidity event feels like a fantastic outcome. Part 2 next week…

I believe these articles provide actionable insights for Nigerian startups. I like to think (and believe) it helps folks grow shareholder value in their own careers and organisations. Folks tell me there is a direct impact on their moral and revenue growth for startup building in Nigeria. And they can sometimes be a little entertaining too. From 2020 I am going to put up a paywall around my articles. Nothing too expensive but just a heads up… School fees are a multi dimensional thing.